|

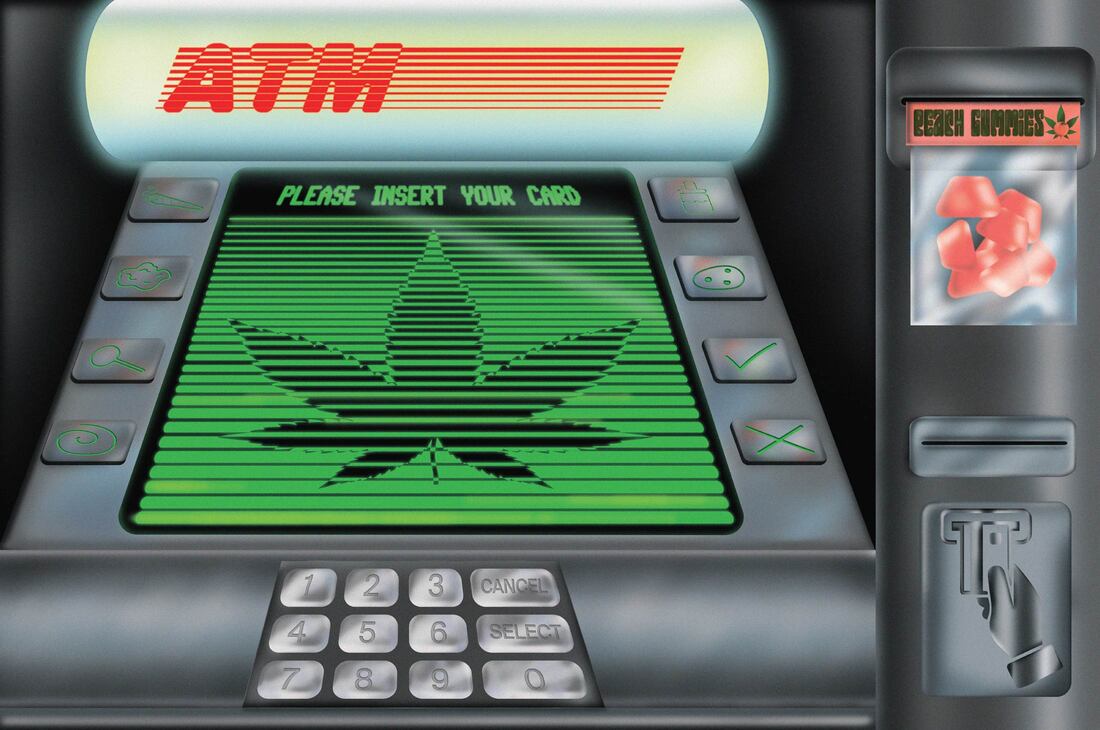

A leading technology hub built by banking industry experts, Zenco offers reliable secure cashless payment options to help cannabis retailers stay in business.

East Brunswick, New Jersey (August 28, 2023) — When Mastercard ordered a halt on all cannabis transactions involving its debit card purchases, it rocked the industry—and its impact continues as retailers scramble for solutions on how to compliantly process cashless payments at an affordable price. With fears that other financial institutions might follow suit, Zenco Payments, a technology hub built by banking industry experts for the cannabis payment ecosystem, offers compliant payment options for businesses to help them remain cashless in a regulatory complaint manner during this tumultuous time. Zenco has built a closed-end loop payment solution that allows consumers to use their cellphone to process the ACH payment thus passing the use of debit cards completely. One of the fastest growing cashless payment solutions nationally, Zenco offers:

Minority owned and operated, Zenco is on a mission to make a positive difference in the sector and streamline payment processes with solutions that are offered to cannabis businesses at some of the lowest rates in the industry. In addition, Zenco is a web-based application and can be operational instantly as it does not require to be integrated with clients’ existing POS systems. Merchants can use Zenco for their in-store, delivery and online e-commerce sales. “The Mastercard shut down is one more hurdle for compliant cannabis businesses that are already navigating a complicated banking system and oftentimes are being gouged by bank fees and limited cashless options,” said Dev Nath, Chief Revenue Officer of Zenco, “Our vision at Zenco is to help cannabis companies by offering them an affordable payment solution that helps increase their sales and improve the shopping experience for their customers.” With over 25 years of experience in banking and related risk management services, Nath has been at the helm of Zenco since 2021 and is a go-to industry expert in financial technology, cannabis banking, digital payments, e-commerce, ERP software, B2B and B2C business solutions, financial advising, and more. “At Zenco, we take our years of mainstream banking expertise and tailor that knowledge and connections to offer compliant and affordable cashless banking solutions to cannabis retailers nationwide,” Nath said. Headquartered in East Brunswick, New Jersey, the company is compliant with all U.S. laws and banking regulations. To learn more about Zenco’s cashless payment solutions for the cannabis sector, visit www.zencopayments.com. About Zenco Payments Inc. Established in 2020, Zenco Payments Inc., a division of Zencorn, is a leading technology hub built by banking industry experts for the cannabis payment ecosystem. Through Zenco Mobile Pay, Zenco B2B Pay, Zenco Debit Pay and Zenco Banking, the company offers reliable single-source, secure payment solutions for cannabis businesses. Headquartered in East Brunswick, New Jersey, the company is compliant with all U.S. laws and banking regulations. Zenco is a web-based application and can integrate with clients’ existing websites and POS systems to capture all sales and transactions. The company’s payment programs help make the cannabis shopping experience convenient, secure, and cashless, and help companies increase the safety of their assets, raise customer satisfaction, increase revenue, and improve their banking relationships. To learn more, visit www.zencopayments.com. Media Contact: Sadie Thompson, Proven Media, 602-527-0794 [email protected]

0 Comments

Leave a Reply. |

Cashless Cannabis PaymentsCannabusinesses continue search for financial service providers.

Weed Shops Switch to Cash After Cashless ATM Crackdown

Cashless ATMs Have Grown Into a $7 Billion Marijuana Loophole

Cannabis Banking Startups Want to Make It Easy to Buy Weed

|

Services

|

Support

|

Connect with us on

|

|

© COPYRIGHT 2021. ALL RIGHTS RESERVED 646 Highway 18, East Brunswick, NJ 08816

|

POWERED BY ZENCORN, LLC

A Proud Minority Owned Company |